3 Step Process we use for cleaning your credit, Establishing Credit, and Securing your first $20,000 in Funding within 60 Days Or Less.

Restore Your Financial Freedom with Royal Empire Credit Repair. Achieve the credit score youdeserve and secure your financial future.

Unlock Financial Freedom with a Strong Credit Score

The Power of Good Credit

Restore Your Financial Freedom with Royal Empire Credit Repair. Achieve the credit score you

deserve and secure your financial future.

Unlock Financial Freedom with a Strong Credit Score

The Power of Good Credit

Restore Your Financial Freedom with Royal Empire Credit Repair. Achieve the credit score you

deserve and secure your financial future.

What Is Credit & Credit Score?

A credit score is a three-digit number that rates your creditworthiness. FICO scores range from 300 to 850. The higher the score, the more likely you are to get approved for loans and for better rates.

Factors Affecting Credit Score

Payment history (35%)

Amounts owed (30%)

New credit (10%)

Credit mix (10%)

Length of credit history (15%)

Factors Affecting Credit Score

Payment history (35%)

Amounts owed (30%)

Length of credit history (15%)

New credit (10%)

Credit mix (10%)

Why Credit repair is Important

Credit repair plays a crucial role in many aspects of life, far beyond just borrowing money. It impacts the financial opportunities available to you, from securing loans to even landing a job.

Here are some key reasons why credit repair is so important:

Access to Better Loan Options

Lenders use your credit score to decide whether to approve loans and what interest rate to offer.

Housing Opportunities

Whether you’re buying a home or renting an apartment, good credit helps you qualify for mortgages and rental agreements.

Lower Insurance Premiums

Many insurance companies use credit scores to determine premiums for auto, home, and other insurance policies.

Emergency Financial Flexibility

Life is unpredictable, and good credit gives you access to emergency funds through credit cards or personal loans when you need it most.

Here are some key reasons why credit is so important:

Access to Better Loan Options

Lenders use your credit score to decide whether to approve loans and what interest rate to offer.

Housing Opportunities

Whether you’re buying a home or renting an apartment, good credit helps you qualify for mortgages and rental agreements.

Lower Insurance Premiums

Many insurance companies use credit scores to determine premiums for auto, home, and other insurance policies.

Emergency Financial Flexibility

Life is unpredictable, and good credit gives you access to emergency funds through credit cards or personal loans when you need it most.

Why Credit is Important

Credit plays a crucial role in many aspects of life, far beyond just borrowing money. It impacts the financial opportunities available to you, from securing loans to even landing a job.

Here are some key reasons why credit is so important:

Pros of Having Good Credit

Having good credit can unlock numerous financial benefits that improve your quality of life. Here are some of the top advantages of maintaining a strong credit score.

Lower Interest Rates on Loans

Higher Credit Limits

Better Credit Card Offers

Easier Approval for Housing

Lower Insurance Costs

Pros of Having Credit repair

Having good credit can unlock numerous financial benefits that improve your quality of life. Here are some of the top advantages of maintaining a strong credit score.

Lower Interest Rates on Loans

Higher Credit Limits

Better Credit Card Offers

Easier Approval for Housing

Lower Insurance Costs

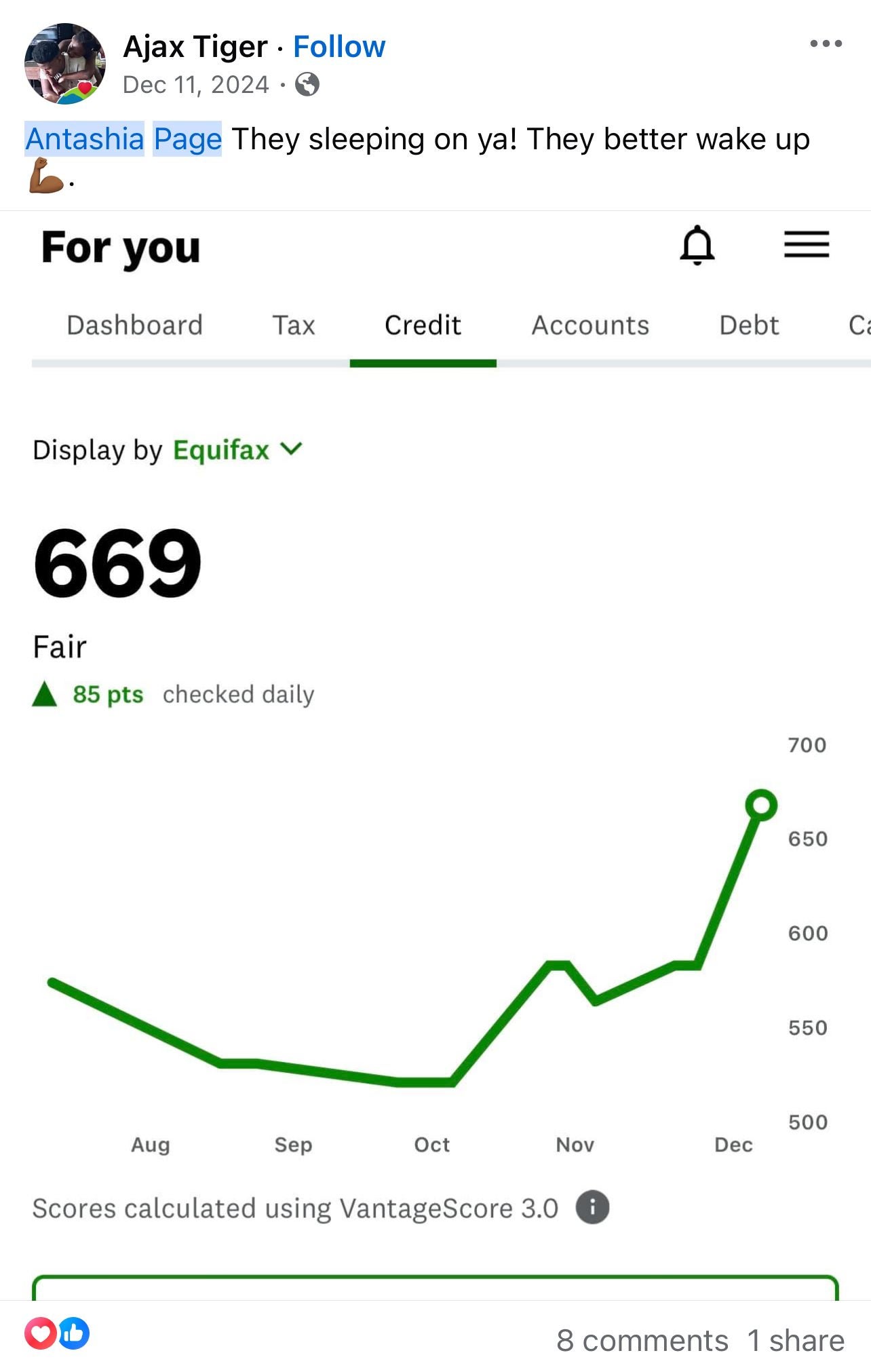

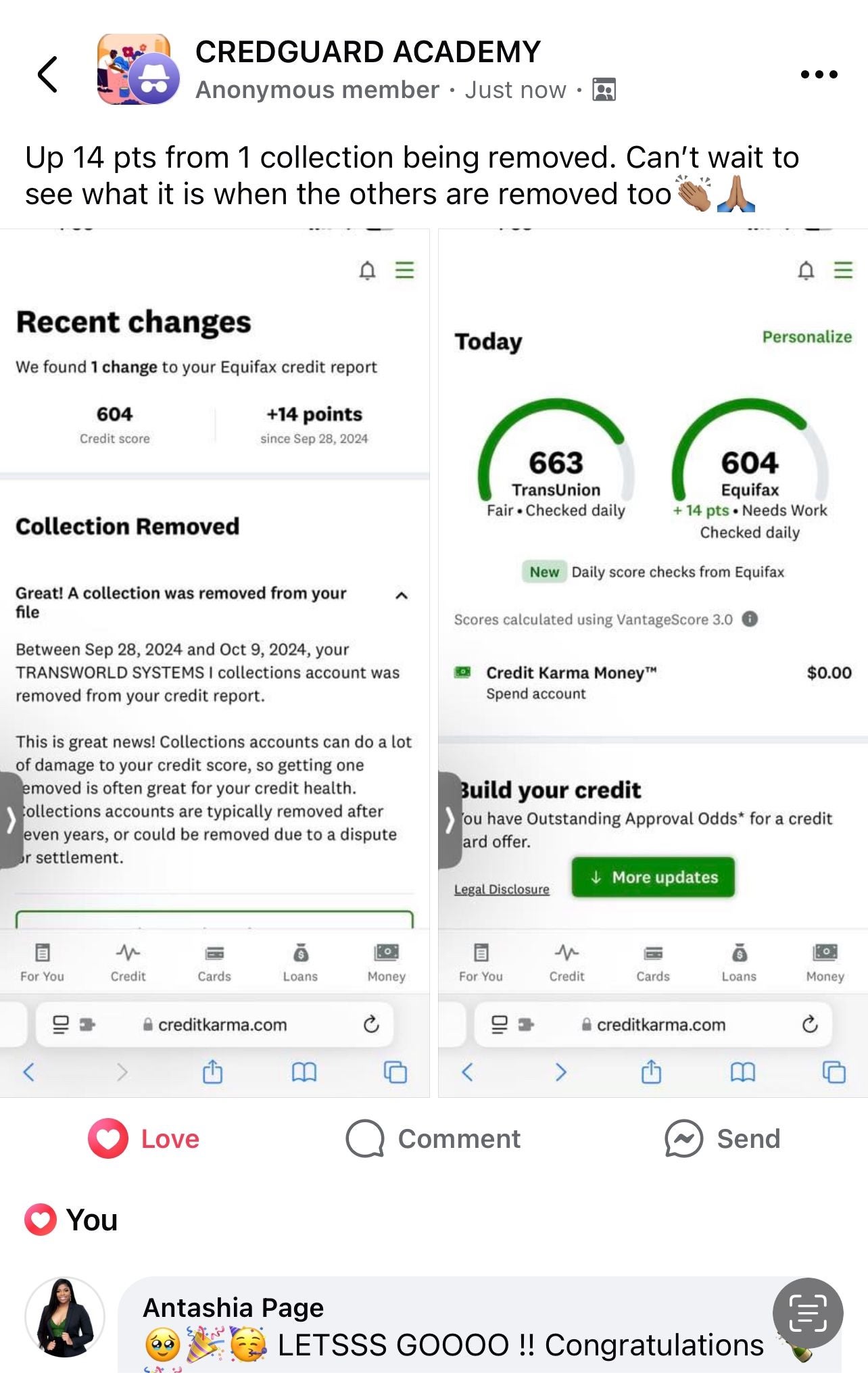

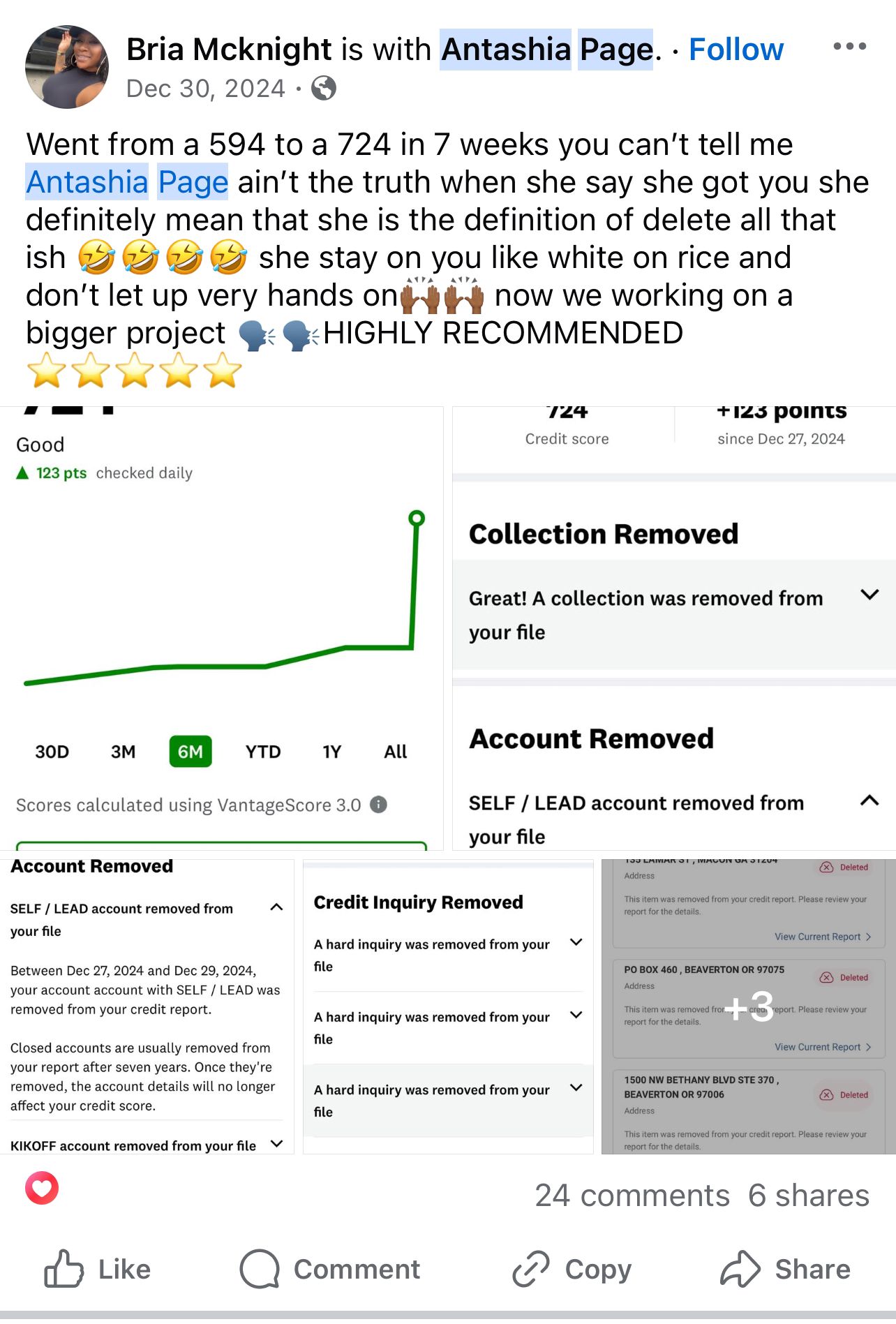

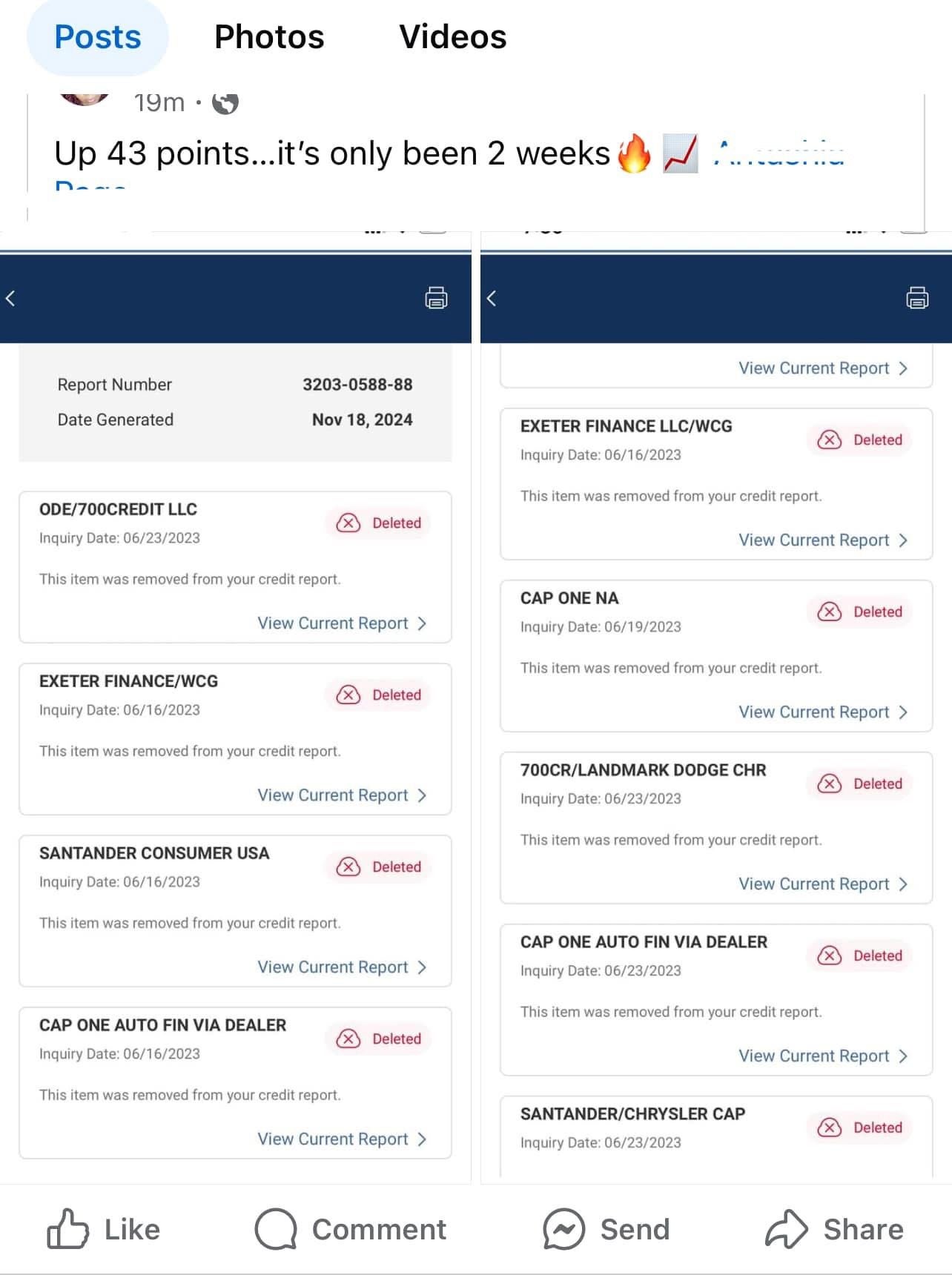

What Our Clients Say

TRUSTED CUSTOMER REVIEWS

Price

4.7

Convenience

4.7

Easy To Use

4.7

Value for Money

4.7

Frequently Asked Questions

Frequently Asked Questions

Our credit repair process involves a thorough review of your credit report to identify errors and negative items. We then dispute inaccuracies with credit bureaus and work diligently to improve your credit score.

To get started, we will need basic personal information. Additionally, providing us with copies of your credit reports and any relevant billing statements will help us assess your situation more effectively.

The timeline for seeing improvements in your credit score can vary depending on the complexity of your case. While some clients may see results in a matter of months, significant changes may take longer to materialize.

Yes, we will handle all communication with creditors and credit bureaus on your behalf. We will dispute inaccurate information, negotiate with creditors, and work to resolve any issues.

To track your progress we recommend downloading the free version of Experian or Credit Karma. These tools provide weekly updates on your credit report, whereas our company receives updates every 30 days. Stay informed and monitor your progress regularly through these platforms.

Building A profitatble Credit Company

©2024. Royal Empire. All Rights Reserved.